The global auto parts supply chain in 2025 feels less like a straight road and more like a detour map. Distributors I speak with — from Dubai parts hubs to Midwest service chains — tell similar stories: containers stuck at ports, cost swings wiping out margins, and SKUs that vanish exactly when demand spikes. These disruptions hit wearable parts hardest. Unlike engines or electronics, parts such as wiper blades and rubber refills don’t fail occasionally — they fail predictably, and in volume.

This is why procurement teams are quietly rewriting their playbooks. Industry advisory firm Roland Berger notes that aftermarket buyers are shifting toward non-OE channels for better value-to-cost balance. In practical terms, many B2B buyers interpret this as a vote for factory-direct auto parts procurement — fewer layers, more control.

I’ve seen distributors burn cash air-freighting wipers they should have received by sea weeks earlier. The part price was low, but the logistics bill wasn’t.

A dedicated wiper factory partner offers what trading channels struggle to match:

A factory partner doesn’t eliminate all disruption. But it shifts the risk center from the buyer to the producer — where mitigation is cheaper and faster.

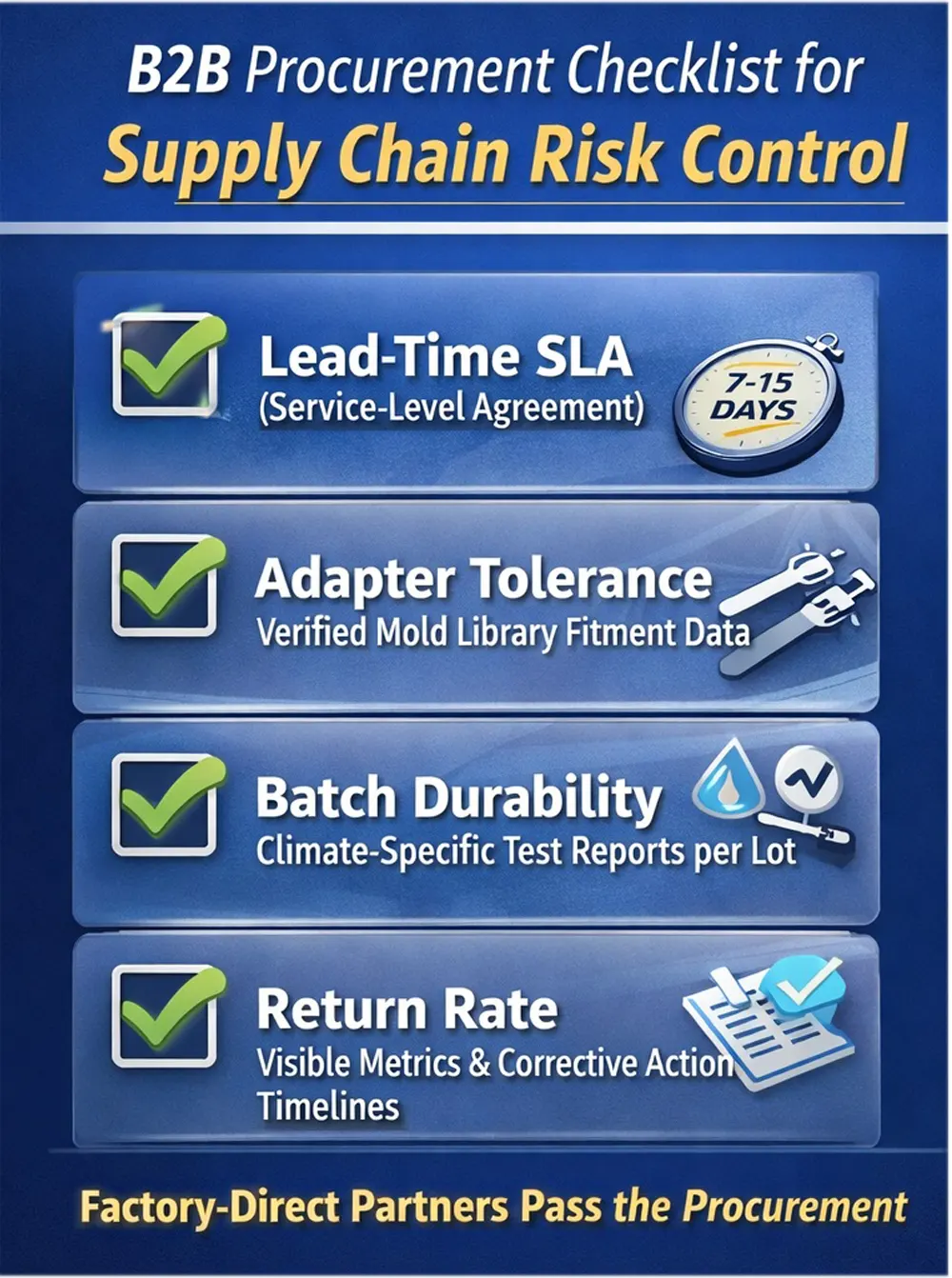

Instead of a generic spec sheet, global distributors increasingly audit:

A checklist is only powerful when someone can prove it. That’s where factory-direct partners win.

Today’s B2B buyer wants predictability more than perfection. The brands that earn purchase orders aren’t the loudest — they’re the most auditable. When wearable parts are at stake, factory-direct sourcing is no longer a trend. It’s the procurement logic of survival.

Partnering with a dedicated wiper factory gives you auditable lead times, verified connector tooling, controlled material batches, and higher SKU fulfillment accuracy — the exact factors top distributors now prioritize to mitigate supply chain risk.

Drop us a message through the chat icon or at wiperblade8@xmyujin.com.

We’re happy to support your sourcing strategy, share wholesale SLAs, and answer your procurement audit questions.